determine the compensation of the Chief Executive Officer after considering the evaluation by the Board of Directors of his performance;

To assist the Compensation Committee with its responsibilities, it has retained the services of the compensation consulting firm, Towers Perrin. The consultant reports to Cathleen P. Black, the Compensation Committee Chair. The roleAdditional information regarding the Compensation Committee’s engagement of executive officers in the compensation processTowers Perrin is describeddisclosed on page 38.42.

Under the terms of its charter, the Committee on Directors and Corporate Governance is responsible for considering and making recommendations concerning the function and needs of the Board, and the review and development of corporate governance guidelines. In fulfilling its duties, the Committee on Directors and Corporate Governance, among other things, shall:

review and recommend all matters pertaining to fees and retainers paid to Directors.

The Chairman of the Committee on Directors and Corporate Governance presides at all meetings of non-management Directors, including the meeting in which the Chief Executive Officer’s performance is evaluated, and at all meetings of independent Directors. The current Chairman of the Committee on Directors and Corporate Governance is James D. Robinson III.

Each member of the Committee on Directors and Corporate Governance meets the independence requirements of the ExchangeNYSE and the Company’s Corporate Governance Guidelines.

In 2007, the Committee on Directors and Corporate Governance engaged the consulting firm Watson Wyatt Worldwide to perform a benchmarking survey on director compensation within the Company’s peer group as described on page 41. The Committee on Directors and Corporate Governance did not request a recommendation on compensation from Watson Wyatt Worldwide.

The Executive Committee

Under the terms of its charter, the Executive Committee has the authority to exercise the power and authority of the Board between meetings, except the powers reserved for the Board or the shareowners by Delaware Law.

The Finance Committee

Under the terms of its charter, the Finance Committee is appointed to assisthelps the Board in dischargingfulfill its responsibilities relating to oversight of the Company’s financial affairs. In fulfilling its duties, the Finance Committee, among other things, shall:

·

formulate and recommend for approval to the Board the financial policies of the Company;

·

maintain oversight of the budget and financial operations of the Company;

·

review and recommend capital expenditures to the Board;

·

evaluate the performance of and returns on approved capital expenditures; and

·

recommend dividend policy to the Board.

The Management Development Committee

Under the terms of its charter, the Management Development Committee aidshelps the Board in dischargingfulfill its responsibilities relating to succession planning and oversight of talent development for senior positions.

The Public Issues and Diversity Review Committee

Under the terms of its charter, the Public Issues and Diversity Review Committee aidshelps the Board in dischargingfulfill its responsibilities relating to public issues and diversity. In fulfilling its duties, the Public Issues and Diversity Review Committee, among other things, shall:

·

review the Company’s policy and practice relating to significant public issues of concern to shareowners, the Company, the business community and the general public;

·

monitor the Company’s progress towards its overall diversity goals, compliance with its responsibilities as an equal opportunity employer and compliance with any legal obligation arising out of employment discrimination class action litigation; and

·

review and recommend the Board’s position on shareowner proposals in the annual proxy statement.

Director Nominations

The Committee on Directors and Corporate Governance will consider recommendations for directorships submitted by shareowners. Shareowners who wish the Committee on Directors and Corporate Governance to consider their recommendations for nominees for the position of Director should submit their recommendations in writing to the Committee on Directors and Corporate Governance in care of the Office of the Secretary, The Coca-Cola Company, P.O. Box 1734, Atlanta, Georgia 30301. Recommendations by shareowners that are made in accordance with these procedures will receive the same consideration by the Committee on Directors and Corporate Governance as other suggested nominees.

In its assessment of each potential candidate, including those recommended by shareowners, the Committee on Directors and Corporate Governance will reviewreviews the nominee’s judgment, integrity, experience, independence, understanding of the Company’s business or other related industries and such other factors the Committee on Directors and Corporate Governance determines are pertinent in light of the current needs of the Board. Diversity of race, ethnicity, gender and age are factors in evaluating candidates for Board membership. The Committee on Directors and Corporate Governance will also taketakes into account the ability of a Director to devote the time and effort necessary to fulfill his or her responsibilities to the Company.

Nominees may be suggested by Directors, members of management, shareowners or, in some cases, by a third-party firm. In identifying and considering candidates for nomination to the Board, the Committee on Directors and Corporate Governance considers, in addition to the requirements set out in the Company’s Corporate Governance Guidelines and its charter, quality of experience, the needs of the Company and the range of talent and experience already represented on the Board.

The Committee on Directors and Corporate Governance sometimes uses the services of a third-party executive search firm to assist it in identifying and evaluating possible nominees for Director. The Company has engaged the firm Egon Zehnder International to assist in the development and execution over time of a boardBoard succession plan.

Certain Related Person Transactions

Herbert A. Allen

Herbert A. Allen, one of our Directors, is President, Chief Executive Officer and a Director of Allen & Company Incorporated (“ACI”) and a principal shareowner of ACI’s parent. ACI is an indirect equity holder of Allen & Company LLC (“ACL”). ACI transferred its investment and financial advisory services business to ACL in September 2002.

ACI has leased and subleased office space since 1977 in a building owned by one of our subsidiaries and located at 711 Fifth Avenue, New York, New York. In June 2005, ACI assigned the lease and sublease to ACL. In 2006,2007, ACL paid approximately $4.0$4.5 million in rent and related expenses and it is expected that ACL will pay a highersimilar amount in 2007 as a result2008 under the terms of a rent escalation clause in the current lease. In the opinion of management, the terms of the lease, which waswere modified in 2002, are fair and reasonable and as favorable to the Company as those whichthat could have been obtained from unrelated third parties at the time of the execution of the lease.

22

Donald F. McHenry

Donald F. McHenry, oneIn 2007, the Company paid ACL $1,000,000 for financial advisory services it provided in connection with a potential transaction. In the opinion of our Directors, had a very small percentage interestmanagement, the terms of the financial advisory services arrangement are fair and reasonable and as a passive shareowner in Brucephil. Mr. McHenry had owned the shares since 1988. The Company, Brucephil and the controlling shareowners of Brucephil entered into various agreements designed to leadfavorable to the acquisition by the Company of the shares of Brucephil not currently owned by the Company. In connection with the agreements, the Company requiredas those that Brucephil repurchase the equity interests of the non-controlling shareowners, including Mr. McHenry. The price for the repurchase was approved by the Company and the Company financed a portion of the associated costs. In connection with the repurchase, Mr. McHenry received approximately $3.0 million for his shares.could be obtained from unrelated third parties.

James D. Robinson III

A daughter-in-law of James D. Robinson III, one of our Directors, has an indirect minority equity interest in Delaware North. Pursuant to certain long-term agreements, the Company is the preferred beverage supplier for Delaware North. In addition, the Company has a sponsorship agreement with a subsidiary of Delaware North relating to the TD Banknorth Garden in Boston. In 2006,2007, the Company paid Delaware North and its subsidiaries approximately $3.2 million in marketing and sponsorship payments in the ordinary course of business. In 2007, Delaware North and its subsidiaries made payments totaling approximately $4.0$4.8 million to the Company directly and through bottlers and other agents to purchase fountain syrups and other products in the ordinary course of business. Also, in 2006 the Company paid Delaware North and its subsidiaries approximately $2.1 million in marketing payments in the ordinary course of business. The Company has had a relationship with Delaware North for over 75 years. In the opinion of management, the terms of the agreements are fair and reasonable and as favorable to the Company as those which could have been obtained from unrelated third parties at the time of the execution of the agreements. Mr. Robinson receives no benefit from this relationship.

Peter V. Ueberroth

A daughter of Peter V. Ueberroth, one of our Directors, is an executive officer of the NBA. The Company and the NBA have entered into a four-year partnershipmarketing agreement. The Company made payments totaling approximately $11.8$8.2 million to the NBA in 20062007 for marketing, media placement, advertising, sponsorship, tickets and other similar itemstickets in the ordinary course of business. The Company has had a relationship with the NBA since the late 1980’s. In the opinion of management, the terms of the agreement are fair and reasonable. Mr. Ueberroth receives no benefit from this relationship.

In addition, a brother of Mr. Ueberroth is an executive officer, director and majority owner of Preferred Hotel Group. The Company and Preferred Hotel Group have entered into a beverage marketing agreement. The Company made payments totaling approximately $153,000 to Preferred Hotel Group in 2007 for beverage marketing services in the ordinary course of business. In the opinion of management, the terms of the agreement are fair and reasonable and as favorable to the Company as those which could have been obtained from unrelated third parties. Mr. Ueberroth receives no benefit from this relationship.

Berkshire Hathaway

Berkshire Hathaway is a significant shareowner of the Company. Additionally, Warren E. Buffett, a Director of the Company until April 19, 2006, is Chairman of the Board, Chief Executive Officer and the major shareowner of Berkshire Hathaway. McLane Company, Inc. (“McLane”) is a wholly owned subsidiary of Berkshire Hathaway. In 2006,2007, McLane made payments totaling approximately $106.7$123 million to the Company to purchase fountain syrup and other products in the ordinary course of business. Also in 2006,2007, McLane received from the Company approximately $6.8$7 million in agency commissions and marketing payments relating to the sale of the Company’s products to customers in the ordinary course of business. This business relationship was in place for many years prior to Berkshire Hathaway’s acquisition of McLane in 2003, is fair and reasonable, and is on terms substantially similar to the Company’s relationships with other customers.

International Dairy Queen, Inc. (“IDQ”) is a wholly owned subsidiary of Berkshire Hathaway. In 2006,2007, IDQ and its subsidiaries made payments totaling approximately $2.0$2.4 million to the Company directly and through bottlers and other agents to purchase fountain syrup and other products in the ordinary course of business. Also in 2006,2007, IDQ and its subsidiaries received promotional and marketing

incentives based on the volume of both corporate and franchised stores, volume totaling approximately $1.1 million$754,000 from the Company and its subsidiaries in the ordinary course of business. This business relationship was in place for many years prior to Berkshire Hathaway’s acquisition of IDQ, is fair and reasonable, and is on terms substantially similar to the Company’s relationships with other customers.

FlightSafety International, Inc. (“FlightSafety”) is a wholly owned subsidiary of Berkshire Hathaway. In 2006,2007, the Company entered into a five-year agreement withpaid FlightSafety to provideapproximately $723,000 for providing pilot, flight attendant and mechanic training services to the Company, services it had provided in prior years. In 2006, the Company paid FlightSafety approximately $468,000 for providing these services to the Company in the ordinary course of business. In the opinion of management, the terms of the FlightSafety contractagreement under which these services are provided are fair and reasonable, and as favorable to the Company as those which could have been obtained from unrelated third parties at the time of the execution of the contract.agreement.

XTRA Corporation is a wholly owned subsidiary of Berkshire Hathaway. In 2006,2007, the Company paid approximately $352,000$233,000 to XTRA Corporation for an equipment leasethe rental of trailers used to transport and store product in the ordinary course of business. In the opinion of management, the terms of the lease are fair and reasonable, and as favorable to the Company as those which could have been obtained from unrelated third parties at the time of the execution of the lease.

Berkshire Hathaway holds a significant equity interest in Moody’s Corporation to which(“Moody’s”). In 2007, the Company paid fees of approximately $318,000 in 2006$234,000 to a subsidiary of Moody’s for rating our commercial paper programs and other services in the ordinary course of business. Also in 2007, the Company paid fees of $370,000 to a subsidiary of Moody’s for rating the Company’s offering of debt securities. The relationship with Moody’s Corporation is fair and reasonable and is on terms substantially similar to the Company’s relationships with similar companies.

Berkshire Hathaway also holds a significant equity interest in American Express Company (“American Express”). In 2006,2007, the Company paid fees of approximately $732,000$709,000 for credit card memberships, business travel and other services in the ordinary course of business to American Express or its subsidiaries. The Company received from American Express approximately $393,000$813,000 in rebates and incentives in the ordinary course of business. The relationship with American Express is fair and reasonable.

Business Wire, Inc. (“Business Wire”) is a wholly owned subsidiary of Berkshire Hathaway. In 2007, the Company paid approximately $150,000 to Business Wire to disseminate news releases for the Company in the ordinary course of business. This business relationship was in place prior to Berkshire Hathaway’s acquisition of Business Wire in 2006, is fair and reasonable, and is on terms as favorable to the Company as those which could have been obtained from unrelated third parties.

Approval of Related Person Transactions

Our policies and procedures regarding related person transactions are in writing in the committee charters for the Committee on Directors and Corporate Governance and the Audit Committee, and in our Codes of Business Conduct. These documents can be found on the Company’s website,www.thecoca-colacompany.com, under the Investors’ section.

A “Related Person Transaction” is a transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) in which the Company (including any of its subsidiaries) was, is or will be a participant and, as relates to Directors or shareowners who have an ownership interest in the Company of more than 5%, the amount involved exceeds $120,000, and in which any Related Person had, has or will have a direct or indirect material interest. Under our policy, there is no threshold amount applicable to executive officers with regard to Related Person Transactions.

A “Related Person” means:

any person who is, or at any time during the applicable period was, a Director of the Company or a nominee for Director or an executive officer;

any person who is known to the Company to be the beneficial owner of more than 5% of the Common Stock;

any immediate family member of any of the foregoing persons, which means any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law of the Director, nominee for Director, executive officer or more than 5% beneficial owner of the Common Stock, and any person (other than a tenant or employee) sharing the household of such Director, nominee for Director, executive officer or more than 5% beneficial owner of the Common Stock; and

any firm, corporation or other entity in which any of the foregoing persons is a partner or principal or in a similar position or in which such person has a 10% or greater beneficial ownership interest.

Related Person Transactions Involving Directors

In general, the Company will enter into or ratify Related Person Transactions only when the Board of Directors, acting through the Committee on Directors and Corporate Governance, determines that the Related Person Transaction is reasonable and fair to the Company.

A “Related Person Transaction” is a transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) in which the Company (including any of its subsidiaries) was, is or will be a participant and the amount involved exceeds $120,000, and in which any Related Person had, has or will have a direct or indirect material interest. A “Related Person” means:

· any person who is, or at any time during the applicable period was, a Director of the Company or a nominee for Director;

· any person who is known to the Company to be the beneficial owner of more than 5% of the Common Stock;

· any immediate family member of any of the foregoing persons, which means any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law of the Director, nominee for Director or more than 5% beneficial owner of the Common Stock, and any person (other than a tenant or employee) sharing the

household of such Director, nominee for Director or more than 5% beneficial owner of the Common Stock; and

· any firm, corporation or other entity in which any of the foregoing persons is a partner or principal or in a similar position or in which such person has a 10% or greater beneficial ownership interest.

When a new Related Person Transaction is identified, it is brought to the Committee on Directors and Corporate Governance to determine if the proposed transaction is reasonable and fair to the Company. The Committee on Directors and Corporate Governance considers, among other things, the recommendationevaluation of the transaction by employees directly involved in the transaction and the recommendation of the Chief Financial Officer.

However, many transactions whichthat constitute Related Person Transactions are ongoing and some arrangements predate any relationship with the Director or predate the Director’s relationship with the Company. For example, ACI’s lease of space at 711 Fifth Avenue predates Mr. Herbert Allen’s service as a Director and was in place when the Company acquired the property as part of the purchase of Columbia Pictures in 1982.

When a transaction is ongoing, any amendments or changes are reviewed and the transaction is reviewed annually for reasonableness and fairness to the Company.

Identifying possible Related Person Transactions involves the following procedures in addition to the completion and review of the customary Directors’ and Executive Officers’ Questionnaires.

The Company annually requests each Director to verify and update the following information:

·

a list of entities where the Director is an employee, director or executive officer;

·

each entity where an immediate family member of a Director is an executive officer;

·

each firm, corporation or other entity in which the Director or an immediate family member is a partner or principal or in a similar position or in which such person has a 5% or greater beneficial ownership interest; and

·

each charitable or non-profit organization where the Director or an immediate family member is an employee, executive officer, director or trustee.

A nominee for Director also is also requestedrequired to provide the Company with the foregoing information.

Related Person Transactions Involving Executive Officers

Any Related Person Transaction involving an executive officer must be preapproved by the Chief Executive Officer. Any such transaction involving the Chief Executive Officer must be submitted to the Audit Committee for approval.

Related Person Transactions Involving Shareowners With More Than Five Percent Ownership

The process for evaluating transactions involving a shareowner who has an ownership interest of more than 5% is essentially the same as that employed for Directors, except that the transactions are submitted to the Audit Committee for approval. The shareowner who has an ownership interest of more than 5% is requested to complete a Principal Shareowner Questionnaire that is similar to questionnaires completed by Directors and executive officers.

Verification Process

When the Company thenreceives the requested information, the Company compiles a list of all such persons and entities, including all subsidiaries of the entities identified. The Office of the Secretary reviews the updated list and expands the list if necessary, based on a review of SEC filings, Internet searches and applicable websites.

Once the list of persons and entities, generally totallingtotaling over 2,5003,000 entities when shareowners who have an ownership interest of more than 5% are included, has been reviewed and updated, it is distributed within the Company to identify any potential transactions. This list also is also sent to each of the Company’s approximately 350360 accounting locations to be compared to the lists of payables and receivables.

All ongoing transactions, along with payment and receipt information, are compiled for each person and entity. The information is reviewed and relevant information is presented to the Committee on Directors and Corporate Governance or the Audit Committee, as the case may be, in order to obtain approval or ratification of the transactions and to review in connection with its recommendations to the Board on the independence determinations of each Director.

Director Compensation

During 2006 there were two plans in place for compensating Directors. For Directors who were not standing for reelection in April 2006, the plan that was already in place was used (the “Prior Plan”). A new plan, the Compensation Plan for Non-Employee Directors of The Coca-Cola Company (the “Directors’ Plan”), was adopted for continuing Directors. The terms of each plan are separately explained below. In addition, all amounts earned under the Directors’ Plan and some of the amounts earned under the Prior Plan were eligible to be deferred under the Directors’ Deferral Plan. That plan is also explained below.

DIRECTOR COMPENSATION IN 2006

(CURRENT DIRECTORS)

Name | | | | Fees

Earned

or Paid

in Cash

($) | | | | Stock

Awards

($) | | | | Option

Awards

($) | | | | Non-Equity

Incentive Plan

Compensation

($) | | | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings ($) | | | | All Other

Compensation

($) | | | | Total

($) | |

(a) | | | | (b) | | | | (c) | | | | (d) | | | | (e) | | | | (f) | | | | (g) | | | | (h) | |

Herbert A. Allen | | | | $0 | | | | $69,912 | | | | $0 | | | | $0 | | | | $0 | | | | $ 0 | | | | $ 69,912 | |

Ronald W. Allen | | | | 0 | | | | 69,912 | | | | 0 | | | | 0 | | | | 0 | | | | 342 | | | | 70,254 | |

Cathleen P. Black | | | | 0 | | | | 69,912 | | | | 0 | | | | 0 | | | | 0 | | | | 342 | | | | 70,254 | |

Barry Diller | | | | 0 | | | | 69,912 | | | | 0 | | | | 0 | | | | 0 | | | | 342 | | | | 70,254 | |

Donald R. Keough | | | | 0 | | | | 69,912 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 69,912 | |

Donald F. McHenry | | | | 0 | | | | 69,912 | | | | 0 | | | | 0 | | | | 0 | | | | 1,021 | | | | 70,933 | |

Sam Nunn | | | | 0 | | | | 69,912 | | | | 0 | | | | 0 | | | | 0 | | | | 600 | | | | 70,512 | |

James D. Robinson III | | | | 0 | | | | 69,912 | | | | 0 | | | | 0 | | | | 0 | | | | 1,021 | | | | 70,933 | |

Peter V. Ueberroth | | | | 0 | | | | 69,912 | | | | 0 | | | | 0 | | | | 0 | | | | 600 | | | | 70,512 | |

James B. Williams | | | | 0 | | | | 69,912 | | | | 0 | | | | 0 | | | | 0 | | | | 1,021 | | | | 70,933 | |

No employee who serves as a Director is paid for those services.

In 2006, the Board of Directors adopted the Directors’ Plan in order to link the pay of the Directors more closely with the interests of shareowners. The Directors’ Plan ties the Directors’ pay to the Company’s performance over a three-year period. If performance goals are not met, the Directors receive nothing. No meeting, attendance or committee chair fees are paid. Executive officers do not play any role in determining or recommending the amount of Director compensation.

How does the Directors’ Plan work?

Under the Directors’ Plan, the Board of Directors, with input from the Committee on Directors and Corporate Governance, sets a performance goal for a three-year period. Every year, each Director, wasexcept a new Director, is credited with theshare units. The number of share units is equal to the number of shares of Common Stock whichthat could be purchased on the first day of the first regularly-scheduled Board meeting, which occurs in February, 16, 2006 with $175,000. On eachWhen a dividend dateis paid on Common Stock, the number of units was adjusted as thoughis increased by the dividends had been reinvested. In February 2009number of shares of Common Stock that could be purchased with the amount of the dividend on the dividend payment date. If the performance forgoal is met at the end of the three-year period, 2006-2008 will be certified. If the performance target is met, the units will beDirectors are paid in cash an amount equal to the number of units multiplied by the fair market value of the shares of Common Stock. If the performance target is not met, the Directors will receive nothing.

For the first three-year performance period the Board set a target of 8% compound annual growth in earnings per share. The Company’s 2005 earnings per share of $2.17 (after considering items impacting comparability) is used as the base for this calculation. No meeting, attendance or committee chair fees are paid under the Directors’ Plan. The Board of Directors has the discretion to make a one-time cash award to any new Director.

The amounts reported in the Stock Awards column (column (c)) reflect the dollar amount, without any reduction for risk of forfeiture, recognized for financial reporting purposes for the fiscal year ended December 31, 2006 of awards of equity share units granted to each of the Directors in 2006, calculated in accordance with the provisions of Financial Accounting Standards Board Statement of Financial Accounting Standards No. 123 (revised 2004), “Share Based Payment” (“SFAS 123R”). The expense is determined by dividing the number of equity share units by three and then multiplying by the average of the high and low prices of the Common Stock on the reporting date. The expense is recorded if the Company’s internal projections determine that it is probable that the performance goal will be met. The grant date fair value of the awards of equity share units to the Directors listed in the Director Compensation in 2006 (Current Directors) table was $175,000.

As of December 31, 2006, each Director listed in the Director Compensation in 2006 (Current Directors) table had 4,347 equity share units which will vest in February 2009 if the performance criterion is satisfied.

DIRECTOR COMPENSATION IN 2006

(FORMER DIRECTORS)

Name

(a) | | | | Fees

Earned

or Paid

in Cash

($)

(b) | | | | Stock

Awards

($)

(c) | | | | Option

Awards

($)

(d) | | | | Non-Equity

Incentive Plan

Compensation

($)

(e) | | | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings ($)

(f) | | | | All Other

Compensation

($)

(g) | | | | Total

($)

(h) | |

Warren E. Buffett | | | | $ 16,500 | | | | $ | 22,980 | | | | | $ | 0 | | | | | $ | 0 | | | | | $ | 0 | | | | | $ | 0 | | | | $ | 39,480 | |

Maria Elena Lagomasino | | | | 15,500 | | | | 22,980 | | | | | 0 | | | | | 0 | | | | | 0 | | | | | 74 | | | | 38,554 | |

J. Pedro Reinhard | | | | 15,500 | | | | 22,980 | | | | | 0 | | | | | 0 | | | | | 0 | | | | | 114 | | | | 38,594 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Since Messrs. Buffett and Reinhard and Ms. Lagomasino did not stand for reelection, they were compensated under the Prior Plan for the portion of the year they served as Directors. Under the Prior Plan, non-management Directors received an annual retainer fee of $125,000, of which $50,000 was paid in cash and $75,000 credited in share units to the account of each Director under the Directors’ Deferral Plan (as discussed below). The retainer was payable quarterly and was prorated for the period of service on the Board. These Directors also received a $1,000 fee for each Board or Committee meeting attended during 2006.

The amounts reported in the Stock Awards column (column (c)) reflect the dollar amount, without any reduction for risk of forfeiture, recognized for financial reporting purposes for the fiscal year ended December 31, 2006 of awards of equity share units granted to each of the Directors in 2006, calculated in accordance with SFAS 123R. The deferred retainer fee of $18,750 is used to determine the number of equity share units credited based on the average high and low prices of the Common Stock on the date the Audit Committee certifies performance results. If the goal is not met, no payment is made.

What happens if a Director leaves the Board before the end of grant. Hypothetical dividends are reinvested into equitythe three-year period?

The share units do not vest upon termination of service as a Director. If a Director does not continue to serve as a Director, the share units credited to his or her account for each performance period in progress are prorated based on the average high and low pricesamount of time in the performance period he or she served as a Director. Thus, for example, if a Director leaves after the first year of the Common Stock on the dividend payment date. The expense is determined by multiplying the number of equity share units by the averageperformance period, he or she would be entitled to one-third of the high and low prices of the Common Stock on the reporting date. The grant date fair value of the awards of share unitspayment made to the Directors listedwho served for the entire three-year period. Any Director who leaves prior to the end of the performance period would receive such prorated payment only after the three-year performance period had ended and only if the goal had been met.

How are new Directors treated?

The Board determined that new Directors would be paid $175,000 for their first 12 months of service, and then participate in the Director Compensation in 2006 (Former Directors) table was $18,750.

The information below is applicable to both tables.

For Directors who elected coverage prior to 2006,performance portion of the Company also provides health and dental insurance coverageDirectors’ Plan on the same terms and cost as available to U.S. employees. In addition, the Company offers to non-management Directorsother Directors. For example, Ms. Herman joined the opportunity to elect insurance coverage, including $30,000 term life insurance for each Director and $100,000 group accidental death and dismemberment insurance. Group travel accident insurance coverageBoard in October 2007. She will be paid $175,000 in cash in quarterly installments over the first 12-month period of $200,000 is provided to all Directors while traveling on Company business. The total costs for these insurance benefits to allservice. Thereafter, she will participate in the performance portion of the non-management DirectorsDirectors’ Plan for the performance period beginning in 2006 was $35,027. The Company also provides its products to Directors. The total cost of Company products provided during 2006 to all2008, but her share

units will be prorated. Assuming that the performance goal for the 2008–2010 performance period is met, she would receive approximately 26/36th of the non-managementpayment made to ongoing Directors was approximately $7,000.who were paid for the entire three-year period.

The amounts shown inCan the All Other Compensation column (column (g)) reflectDirectors defer any of the premiums for life insurance provided to each Director during 2006. For Messrs. Buffett and Reinhard and Ms. Lagomasino the amount reflects the premium during their service on the Board during 2006.payment they receive?

The Directors’ Deferral Plan provides that non-management Directors may elect to defer receipt of all or part of the cash settlement of the share units, if earned, under the Directors’ Plan or the $50,000 cash portion of the retainer under the Prior Plan, until date(s) no earlier than the year following the year in which they leave the Board. UnderIf a Director defers the payout of the share units, the amount that would have been paid is credited to an account under the Directors’ Deferral Plan, retainer fees may be deferredPlan. Each Director elects to have his or her account credited with earnings as if the account is invested in share units or cash. Cash deferrals are credited with interest at the prime lending rate of SunTrust Bank. Share units are credited with hypothetical dividends and appreciate (or depreciate) as would an actual share of Common Stock purchased on the deferral date. Both cash deferrals and share unit deferrals will be paid in cash in accordance with the terms of the Directors’ Deferral Plan.cash. The Directors’ Deferral Plan does not provide for above market or preferential earnings (as those terms are defined by the SEC).

28How are the plans in progress performing?

As of December 31, 2007, there were two performance periods ongoing under the Directors’ Plan: the 2006–2008 performance period and the 2007–2009 performance period. For the 2007–2009 performance period, the share units were credited based on the value of Common Stock on February 15, 2007. The number of units credited to each Director at the beginning of that period was 3,658.

For both the 2006–2008 performance period and the 2007–2009 performance period, the Board set a target of 8% compound annual growth in earnings per share. For the 2007���2009 performance period, the Company’s 2006 earnings per share of $2.37 is used as the base for this calculation. For the 2006–2008 performance period, the Company’s 2005 earnings per share of $2.17 is used as the base for this calculation. For both performance periods, the calculation of earnings per share growth is adjusted for significant structural changes, accounting changes, and non-recurring charges and gains. The Audit Committee must approve and certify any adjustments. These adjustments are intended to provide a consistent year-to-year comparison. In February 2009, the Audit Committee will review and certify the Company’s earnings per share performance for the 2006–2008 performance period. In February 2010, the Audit Committee will review and certify the Company’s earnings per share performance for the 2007–2009 performance period. Currently, it is anticipated that the targets for both periods will be met.

As of December 31, 2007, each Director, except Ms. Herman and Mr. Wallenberg, who began his service as a Director on January 1, 2008, had 8,204 total share units, with a total aggregate value of $503,479. These share units relate to the two performance periods, as follows:

| | | | | | |

| | | Share Units as of

December 31, 2007 | | Payment Date | | Value as of

December 31, 2007 |

2006–2008 Performance Period | | 4,455 | | February 2009, if the performance goal is met | | $273,403 |

2007–2009 Performance Period | | 3,749 | | February 2010, if the performance goal is met | | $230,076 |

Director Compensation in 2007

| | | | | | | | | | | | | | |

Name (a) | | Fees

Earned

or Paid

in Cash

($) (b) | | Stock

Awards

($) (c) | | Option

Awards

($) (d) | | Non-Equity

Incentive Plan

Compensation

($) (e) | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings ($) (f) | | All Other

Compensation

($) (g) | | Total ($) (h) |

Herbert A. Allen | | $ 0 | | $189,072 | | $ 0 | | $ 0 | | $ 0 | | $ 3 | | $189,075 |

Ronald W. Allen | | 0 | | 189,072 | | 0 | | 0 | | 0 | | 615 | | 189,687 |

Cathleen P. Black | | 0 | | 189,072 | | 0 | | 0 | | 0 | | 357 | | 189,429 |

Barry Diller | | 0 | | 189,072 | | 0 | | 0 | | 0 | | 357 | | 189,429 |

Alexis M. Herman | | 43,750 | | 0 | | 0 | | 0 | | 0 | | 3 | | 43,753 |

Donald R. Keough | | 0 | | 189,072 | | 0 | | 0 | | 0 | | 3 | | 189,075 |

Donald F. McHenry | | 0 | | 189,072 | | 0 | | 0 | | 0 | | 1,036 | | 190,108 |

Sam Nunn | | 0 | | 189,072 | | 0 | | 0 | | 0 | | 20,164 | | 209,236 |

James D. Robinson III | | 0 | | 189,072 | | 0 | | 0 | | 0 | | 1,036 | | 190,108 |

Peter V. Ueberroth | | 0 | | 189,072 | | 0 | | 0 | | 0 | | 12,164 | | 201,236 |

James B. Williams | | 0 | | 189,072 | | 0 | | 0 | | 0 | | 17,319 | | 206,391 |

No employee who serves as a Director is paid for those services. Mr. Wallenberg began his service as a Director on January 1, 2008 and therefore is not included in the table above.

Fees Earned or Paid in Cash (Column (b))

Other than Ms. Herman, no Director received any cash payment for services in 2007. As a new Director, Ms. Herman received cash compensation instead of participating in the performance portion of the Directors’ Plan, as described in the narrative above. The amount reported in the Fees Earned or Paid in Cash column for Ms. Herman reflects the cash amount paid for 2007.

Stock Awards (Column (c))

The amounts reported in the Stock Awards column reflect the expense associated with each Directors’ share units under the Directors’ Plan, calculated in accordance with the provisions of Financial Accounting Standards Board Statement of Financial Accounting Standards No. 123 (revised 2004), “Share Based Payment” (the “Equity Accounting Rules”). Even though the units may be forfeited, the amounts reported do not reflect this contingency. The amounts reported reflect the expense for a portion of each of the two performance periods since the three-year performance periods overlap. The total amount represents $112,373 for the 2006–2008 performance period and $76,699 for the 2007–2009 performance period. The expense is determined by dividing the number of share units for each three-year period by three and then multiplying that number by the average of the high and low prices of the Common Stock on the reporting date. The expense is recorded if the Company’s internal projections determine that it is probable that the performance goal will be met. The value of the share unit awards on February 15, 2007, the grant date, was $175,000.

All Other Compensation (Column (g))

The amounts reported in the All Other Compensation column reflect the premiums for business travel accident insurance, life insurance (including accidental death and dismemberment coverage), medical and dental insurance, and Company matching gifts to non-profit organizations for Directors who participated in that program.

For Directors who elected coverage prior to 2006, the Company provides health and dental insurance coverage on the same terms and cost as available to U.S. employees and life insurance coverage, which includes $30,000 term life insurance and $100,000 group accidental death and dismemberment insurance. The premiums for life insurance (including accidental death and dismemberment) were: for each of Messrs. Ronald Allen, Nunn and Ueberroth, $611; for both Ms. Black and Mr. Diller, $354; and for each of Messrs. McHenry, Robinson and Williams, $1,033. Group travel accident insurance coverage of $200,000 is provided to all Directors while traveling on Company business, at a Company cost of $3 per Director. The total cost for these insurance benefits to all of the non-management Directors in 2007 was $37,059.

The Directors are eligible to participate in the Company’s matching gifts program. In 2007, this program matched up to $4,000 of charitable contributions to tax-exempt arts, cultural, or educational organizations, on a two for one basis. The total cost of matching contributions on behalf of the Directors for 2007 was $16,000.

The Company also provides its products to Directors. The total cost of Company products provided during 2007 to all of the non-management Directors was approximately $7,000.

COMPENSATION DISCUSSION AND ANALYSIS

Overview

We pay for performance. By this, we mean that rewards are not paid when results are not delivered. Likewise, we provide increased rewards for extraordinary results. In 2007, the Company’s total return to shareowners, representing share price appreciation and dividends, was 30%. This total return ranks in the top quartile of the Company’s peer group as set forth on page 41. Executive compensation in 2007 reflected this strong performance. The Company’s pay for performance philosophy was evident in the specific elements of compensation in 2007 as follows:

Annual Incentive: Performance exceeded targets under the annual incentive plan and, as a result, payments from the annual incentive plan were above the target amount, but below the maximum amount, as plan participants, including the Named Executive Officers, were rewarded for excellent performance.

Long-Term Equity Compensation: The Company’s strong performance also contributed to the probability of meeting or exceeding targets for the ongoing performance share unit programs. In addition, because of share price appreciation, the value of outstanding stock options increased. At the same time, however, when the Compensation Committee certified the performance results in February 2007 for the 2004–2006 performance period, one-third of the performance share units were forfeited because the performance targets for the three-year period were not fully met. In addition, in October 2007, 8,918,533 options granted in 1997, including options held by the Named Executive Officers, expired unexercised because the market value of a share of Common Stock did not exceed the exercise price at that time.

Generally, we have no employment contracts with our executives or employees, unless required or customary based on local law or practice. With respect to the Named Executive Officers, we have a contract only with Mr. Reyes since all of our employees in Mexico have employment contracts in accordance with Mexican law.

As these results illustrate, our compensation programs contribute to a high-performing culture and help focus employees, including the Named Executive Officers, on delivering results that drive sustainable growth.

Overall Compensation Philosophy and Objectives

Our compensation philosophy is to drive and support the Company’s long-term goal of sustainable growth and total shareowner return.return by paying for performance. By “sustainable growth,” we mean investing in our long-term opportunities while meeting our short-term commitments.

We have a global compensation framework that is designed to ensure that:

•

our rewards reinforce a high-performing culture;

•

we develop our employees to their highest potential;

•

we focus on those programs that will drive sustainable growth and that employees value; and

•

we have a common and transparent approach for decision makingdecision-making with respect to compensation decisions.

We design our compensation programs to:

·

make clear the relationship between the performance of each of our employees, including the Named Executive Officers, and the Company’s overall performance;

·

pay for performance and behaviors that reinforce the values underlying our “Manifesto for Growth,” including leadership, passion, integrity, accountability, collaboration, innovation and quality;

· achieve our objectives, yet

be transparent in intent and simple in design; and

·

optimize our investment in labor costs by investing in those plans that not only drive business performance but that are competitive and valued by our employees, including the Named Executive Officers.

We pay for performance. When the Named Executive Officers deliver results commensurate with pre-set quantifiable objectives, they are rewarded accordingly. Our approach is more fully explained below. We have designed our programs in this manner to ensure that a significant portion of executive compensation is at risk, and subject to performance criteria aligned with creating return for our shareowners. Our approach is more fully explained below.

Generally, we have no employment contracts with our executives or employees, unless required by local law. There is a contract with Mr. Reyes since all of our Mexican employees have employment contracts in accordance with Mexican law.

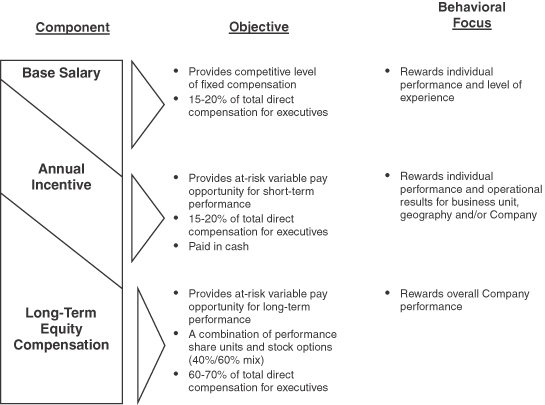

Elements of Compensation

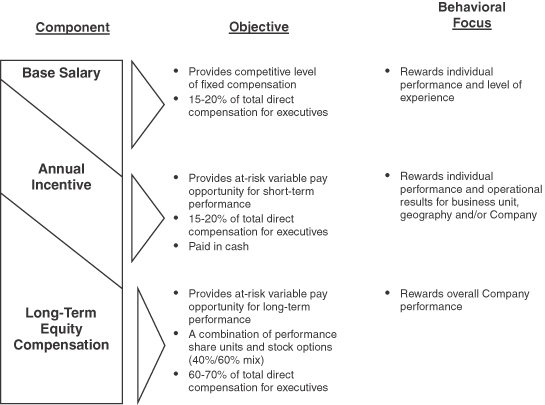

Each element of our compensation programs is intended to encourage and foster the following results and behaviors:

Total direct compensation is comprised of base salary, annual incentives and long-term equity compensation.

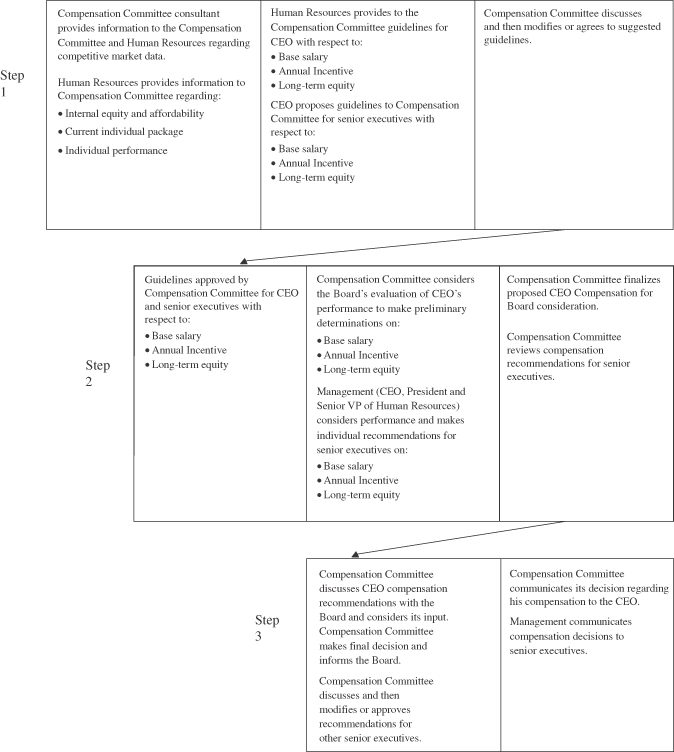

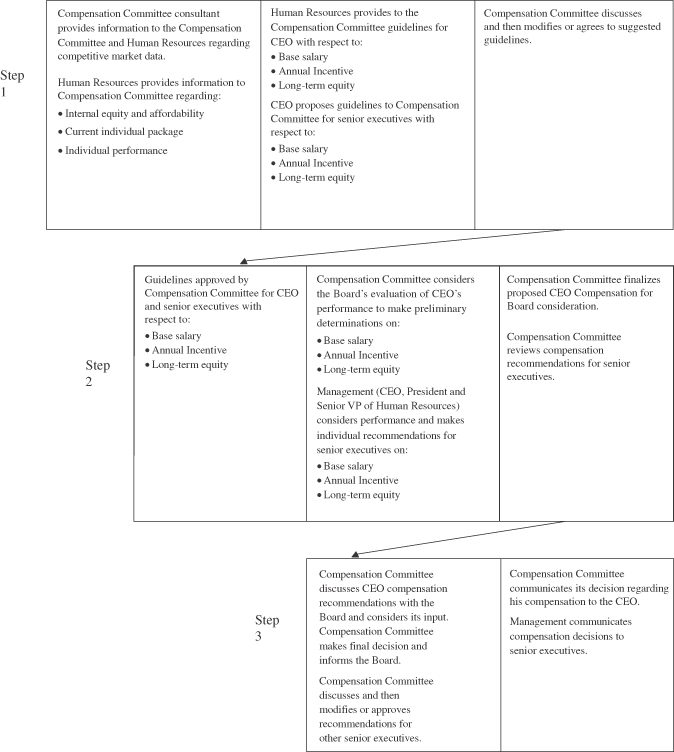

Decision-Making Process and Role of Executive Officers

The following chart provides an overview of how compensation decisions are made for the Named Executive Officers, including the role of executive officers.

Annual Compensation

Base Salary. We pay a base salary to attract talented executives and provide a securefixed base of cash compensation. Annual increases, typically determined by the Compensation Committee in February of each year, are not assured and adjustments take into account the individual’s performance, responsibilities, experience, and internal equity, as well as external market practices that are discussed under “Benchmarking” below. The process for determining base salary is the same for all of our employees, including the Named Executive Officers.

Base salary guidelines for the executive officers are set by the Compensation Committee, based on their subjective determination, after considering considering:

competitive market datadata;

internal equity and affordabilityaffordability;

the employee’s current compensation; and

As described in the “Benchmarking” section on page 41 below, we use a peer group of companies to determine the competitiveness of base salaries. Since several other elements of compensation are driven by base salary, the Compensation Committee is careful to set the appropriate level of base salary. We do not seek to set the base salary of any employee, including any Named Executive Officer, at a certain multiple of the salary of another specified employee.

Internal equity in this context means ensuring that employees with similar responsibilities, experience and historical performance are rewarded comparably. Affordability is also used in determining base salaries and annual increases. What we pay our employees, including the Named Executive Officers, eventually is factored into the price of our products. We look at base salary, annual incentive opportunities and long-term incentive awards to understand whether total direct compensation is competitive and affordable.

For each position in the Company, including the Named Executive Officers’ positions, we assign a job grade based on job duties and responsibilities. Each job grade has a salary range. When adjusting base salaries, annual increases are awarded based on the Compensation Committee’s assessment of the employee’s experience, performance for the Company.previous year, and performance versus peers in comparable roles. These increases generally are awarded within a pre-established range approved by the Compensation Committee. We seek to provide the highest performing employees the highest rewards.

In general, there are three situations that may warrant an adjustment to base pay: annual merit increases, promotions or changes in role, and market adjustments.

Annual merit increases.The Compensation Committee reviews potential merit increases in February and merit increases, if any, are usually effective April 1. Annual merit increases are not guaranteed and adjustments take into account the individual’s performance, responsibilities, experience, as well as internal equity and external market practices that are discussed under “Benchmarking” below. Individual increases are determined after a case-by-case evaluation by the executive’semployee’s manager. This is intended to encourage executives to meet their personal goals, which include developing talent, personal skill development and similar goals.

The Chief Executive Officer then evaluatesand the President evaluate recommendations for each of the other Named Executive Officer prior to submittingOfficers and submit them to the Compensation Committee for final review and approval. The Compensation Committee relies to a large extent on the Chief Executive Officer’s and President’s evaluation of eachthe other Named Executive Officer’s performanceOfficers’ performance.

Promotions or changes in deciding whetherrole.We also may recommend a salary increase to makerecognize an adjustment to his or her base salaryincrease in a given year. In the case ofresponsibilities resulting from a change in an employee’s role weor a promotion to a new position. We carefully consider new responsibilities, external pay practices and internal equity in addition to past performance and experience.experience when making such salary changes.

With respectMarket adjustments. Market adjustments are awarded to our Chief Executive Officer,individuals who are performing successfully when we recognize a significant gap between the market data and the individuals’ base salaries. These gaps can be driven by inflation or by scarce supply of talent for a particular role. In general, market adjustments are determined as part of the annual merit review process.

Actions taken in 2007. The Compensation Committee reviewed external market data to ensure that Mr. Isdell, theIsdell’s salary remained competitive. The full Board approvesalso reviewed Mr. Isdell’s performance against his individual goals at the beginning of each year and evaluates his progress against the goals at mid-year and at the end of

the year. In 2006,goals. Based on these reviews, the Compensation Committee made no increase to Mr. Isdell’s base salary. The Compensation Committee was of the view thatincreased Mr. Isdell’s base salary by 10% effective April 1, 2007. An increase of 10% was at a competitive level and that any adjustments to compensationdeemed appropriate because of Mr. Isdell’s strong performance, because he had not received an increase in 2006 should focus on the long-term nature of his responsibilities. The Compensation Committee awarded a 10% increase for Mr. Fayard, a 5% increase for Ms. Minnick and a 5% increase for Mr. Reyes. Mr. Kent’s base salary since he was first increased 60%appointed Chief Executive Officer in February 2006 as a result of his promotion to President, Coca-Cola International. This promotion gave2004, and because market data indicated higher base salaries for CEO positions.

As previously disclosed, Mr. Kent operational responsibility for operating groups accounting for more than 80% of the Company’s operating profit. Mr. Kent’s salary was subsequently increased an additional 25% effective January 1, 2007 as a result of his promotionpromoted to President and Chief Operating Officer in December 2006. As a result, the Compensation Committee approved a 25% increase to Mr. Kent’s base salary effective January 1, 2007. This increase included an annual merit increase and an amount to recognize his promotion.

The Chief Executive Officer and the President reviewed business and individual performance for the other Named Executive Officers. Based on this review, they proposed to the Compensation Committee the following, which were approved:

a 12% increase effective April 1, 2007 to Mr. Fayard, which included an annual merit increase and an adjustment to better align his salary with the market, based on a review of the Company. The increases for these Named Executive Officers werepeer group;

Mr. Finan’s salary was increased 23% in December 2006, effective January 1, 2007, which included both a resultmerit increase and an adjustment to better align his salary with the market, based on his increased responsibilities and a market review of the process described above.similar positions; and

a 5.5% increase effective April 1, 2007 to Mr. Reyes reflecting an annual merit increase.

Annual Incentive. While our goal is long-term sustainable growth,As a component of total compensation, the Compensation Committee chooses to pay annual incentives to rewarddrive the achievement of key results for the business and to recognize business units and individuals based on their contributions to those results. The Compensation Committee recognizes that short-term results contribute to achieving long-term goals. The amount of the annual incentive payout to all eligible employees, including the Named Executive Officers, for individual performance and operational results for an operating group and/or overall Company performance on an annual basis. The annual objectives are carefully chosen to ensure integration and alignment with our overall long-term objectives. At the start of the incentive period, a target amount is designated by the Compensation Committee,determined based on a formula. This formula is:

Base Salary X Annual Incentive Target % X Business Performance Factor % X Personal Performance Factor %

To illustrate how the formula works, assume that a Named Executive Officer had a base salary of $650,000 and an annual incentive target of 125% of base salary. Hypothetically, assume that actual performance resulted in a 115% Business Performance Factor and the executive’s Personal Performance Factor was 105%. Using these hypothetical assumptions, the Named Executive Officer’s annual incentive payout would be:

| | | | | | | | | | | | | | | | |

Base Salary | | | | Annual Incentive Target (% of base salary) | | | | Hypothetical

Business

Performance Factor | | | | Hypothetical

Personal

Performance Factor | | | | Total

Annual

Incentive |

| $650,000 | | X | | 125% | | X | | 115% | | X | | 105% | | = | | $981,094 |

Each of these factors are described in more detail below.

Annual Incentive Target. The Annual Incentive Target percentage of base salary. In 2006, annual target percentagessalary is determined by each executive’s job grade and is consistent throughout the world for a particular job grade. For 2007, the Annual Incentive Targets for the Named Executive Officers were: Mr. Isdell 200%, Mr. Kent 150%, Mr. Fayard 125%, Ms. Minnick 125%, and Mr. Reyes 125%.

| | |

| Mr. Isdell | | 200% |

| Mr. Kent | | 175% |

| Mr. Fayard | | 125% |

| Mr. Finan | | 125% |

| Mr. Reyes | | 125% |

Business Performance Factor.The amountBusiness Performance Factor percentage is the result of anmeasuring actual award is based on financial and individualresults against pre-established business objectives that are set in February for the upcoming year. The Compensation Committee typically selects two or three key business performance measured at the end of the fiscal year. In 2006, approximately 8,700 employees,measures that will focus participants, including the Named Executive Officers, participated inon behaviors that will drive long-term sustainable growth. The measures may be different for the Company as a commonwhole and for the operating units. Our annual incentive plan.

Financial Performance. Financial performance is determined after the end of the fiscal year based on actual business results versus pre-established business objectives. Generally, the Compensation Committee sets the annual financial performance percentages, which determine payouts, at the beginning of the performance period within a range for possible financial performance levels. The final financial performance is reflected as a percentage amount. For example, achieving target financial performance would yield an award of 100% of the target amount set at the beginning of the year. Financial performance determines the total amount of dollars available for the incentive pool.

Our incentive plans includeplan includes a wide variety of shareowner-approved measures of business performance from which the Compensation Committee may choose in establishing performance targets. These are:

· unit case sales (volume)

| | · growth in economic profit

|

· earnings per share

| | · operating profit or operating profit margin

|

· net income

| | · share of sales

|

· return on assets

| | · average annual growth in earnings per share

|

· total shareowner return

| | · shareowner value

|

· cash flow

| | · gross profit

|

· economic value added

| | · profit before tax

|

· revenue growth

| | · quality as determined by the Company’s quality index

|

· operating expenses

| | |

The Compensation Committee typically selects two or three measures at the beginning ofto establish the performance period that will focus the participants, including the Named Executive Officers, on those behaviors and short-term decisions that will drive sustainable growth.

When deciding what financialmeasures to use at the start of a plan year, and the target level of achievement of those measures, the Compensation Committee carefully considers the state of the

Company’s business and what measures are most likely to focus the participants, including the Named Executive Officers, on making decisions that deliver short-term results aligned with our long-term goals. Financial performance is measured separatelytargets for the Company as a whole and for an operating unit. In 2006, performance for the Company as a whole was measured 50%year. These are described on volume and 50% on net income. For an operating unit, the measure was 50% volume and 50% profit before tax, both calculated for the operating unit. Additionally, the Compensation Committee required specific volume metrics for different types of products, such as sparkling beverages and water. In February 2006, the Compensation Committee set the minimum, target and maximum levels for each measure. The levels vary by geography due to the volatility of certain emerging markets. Named Executive Officers receive:

·page 75. no payment for results that do not meet a minimum performance level;

· a payment of at least 10% but less than 100% of the target award opportunity if the minimum level of performance is exceeded but does not meet the expected level of performance;

· a payment of at least 100% but less than 200% of the target award opportunity if the level of performance achieves or exceeds the target performance level but does not attain maximum performance level; and

· a payment of 200% of the target award opportunity if the maximum level of performance is met or exceeded.

In each case, the amount of the payment actually received will also depend on individual performance, as described below.

Financial performance has exceeded the target in each of the last three years, though the maximum has never been achieved.

Depending on the Named Executive Officer’s responsibilities, financial performancethe Business Performance Factor is measured and determined based solely on Company-wide performance, or a combination of Company and operating group performance. For 2007, the annual incentives for all of the Named Executive Officers, except Mr. Reyes, were based on Company-wide performance because their responsibilities are substantially for the Company as appropriate. Performance objectives for Messrs. Isdell and Fayard and Ms. Minnick were determined entirely on total Company performance.a whole. Mr. Kent’s financial performance percentageReyes’ annual incentive was determined based 50% on Company-wide performance and 50% on Latin America Group results because he is responsible for the Latin America Group.

For 2007, the Compensation Committee chose volume and net income as performance ofmeasures for the Company as a whole, and 50%volume and profit before tax as the performance measures for the operating units. These measures were chosen because they are correlated to long-term sustainable growth in our business and are aligned with our strategic plan. In addition, in order to achieve more than 100% of target on the volume measure, a minimum level of performance with respect to volume must be achieved for specific categories of Coca-Cola International. Mr. Reyes’ financialbeverages.

Payout grids are established at the beginning of each performance percentage was determined based 50% onperiod using the performance of the Company as a whole and 50% on the Latin America Group’s performance. The financial performance is reviewedmeasures selected by the Audit Committee and certified by the Controller prior to the February meeting of the Compensation Committee. The Compensation Committee carefully considers any possible exceptions, such asplan is designed to provide a matrix of performance points at which the occurrence of a natural disaster or political turmoil in a given location or other circumstances. There were no special adjustments in 2006 that affectedtarget annual incentive could be earned. The chart below details the compensation of any of the Named Executive Officers. potential payouts:

| | |

| Business Performance* | | Payouts |

| Performance exceeded expectations | | >100% – 200% |

| Performance met expectations | | 100% |

| Performance met minimum performance requirement but did not fully meet expectations | | 10% – <100% |

| Performance did not meet minimum expectations | | 0% |

| * | As determined against a matrix of possible outcomes |

The Compensation Committee determinedsets the target awards to usebe challenging, but reasonably attainable. The maximum award is intended to be very difficult to achieve. Based on historical analysis, we believe the sametarget award is somewhat likely, but not easily achieved. There is only a remote probability (less than 5%) that the maximum award could be attained. Past performance measuresis not an indication of future performance, but provides valuable data to the Compensation Committee as it sets targets for the plan year. Over the last eight years, the business performance targets were exceeded slightly more than half of the time, but the maximum payout was never awarded. As disclosed in the 2007 annual incentive plan.Grants of Plan-Based Awards Table on page 58, the target award for 2007 was exceeded, but the maximum was not attained for any Named Executive Officer.

Personal Performance.Performance Factor. Individual performanceThe Personal Performance Factor is determined after the end of the fiscal year based on an evaluation of actual performance of the individual participants, in the annual incentive plan, including the Named Executive Officers, versus their pre-established individual objectives. TheseThe levels of performance and the corresponding Personal Performance Factor range from 0% – 160%, and are as follows:

| | |

| Performance Rating | | Personal Performance Factor Range |

| Exceptional Performance | | 125% – 160% |

| Successful Performance | | 90% – 125% |

| Developing Performance | | 0% – 90% |

| Does Not Meet Expectations | | 0% |

If the minimum personal performance is not attained by an individual, there is no incentive paid, regardless of Company performance.

The Compensation Committee approves the Chief Executive Officer’s objectives. The President sets his objectives after discussion with the Chief Executive Officer. For the other Named Executive Officers, the objectives were set for each Named Executive Officer after individual discussion with the Chief Executive Officer and applied toor the personal performance factor of the annual incentive as well as to the base salary increase process. The personal performance factor is multiplied by the financial results to determine the final award amount. The personal performance factor varies from 0% to 160%. The evaluation of the participants, including the Named Executive Officers, results in a personal performance factor which is also reflected as a percentage. For example, achieving target individual performance would yield a result of 100%.

32

Determination Formula.The amount of each actual annual incentive award payout, including the payout to our Named Executive Officers, is determined as follows:

Base Salary ´ Annual Incentive Target %

´ Financial Performance % ´ Personal Performance Factor %

In addition, the annual incentive is adjusted up or down to reflect performance against pre-established inclusion and diversity goals. If performance is below the set goals, the annual incentive for U.S. based senior executives, including the U.S. based Named Executive Officers, is reduced by up to 20%. If goals are exceeded, the annual incentives for U.S. based senior executives, including the U.S. based Named Executive Officers, can be increased by up to 2%. For 2006, the Company exceeded its goals and incentives for U.S. based Named Executive Officers were increased by less than 1%.

The determination of the annual incentive payments, as well as base salary increases, does not impact the calculation of the other elements of total direct compensation.President.

Incentive for Mr. Isdell. In determining Mr. Isdell’s 20062007 annual incentive award, the Compensation Committee took into account his leadership of the organization and the Company’s strong performance over the past year. In particular, the Company delivered results at the top end ofthat exceeded its long-term volume and profit targets. The Company achieved 4% growth in sparkling beverages – the highest growth since 1998 – and 7% growth in still beverages. The Company also returned $5.4 billion to shareowners, through stock repurchases and dividends. OurCompany’s total return to shareowners, representing share price appreciation and dividends, was 23%30%, and the Company achieved 4% growth in 2006.

sparkling beverages and 12% growth in still beverages. In addition, Mr. Isdell:

· reinvigorated marketing

made strides in repositioning the U.S. business for growth, including the acquisition of glacéau;

completed succession planning for the Chief Executive Officer role and accelerated innovation, including nearly 600 new product launches;designed a smooth transition plan;

·

continued to lead the Company’s efforts in the area of corporate social responsibility; and

improved the Company’s executive bench strength and leadership pipeline;structure.

Incentives for other Named Executive Officers. In determining the incentives for the other Named Executive Officers, in addition to the Company’s strong business performance, the Chief Executive Officer and the Compensation Committee considered their personal accomplishments. Specifically:

· improved Company-owned bottling operations

Mr. Kent focused on business and createdcapability issues in key markets, enhanced the Company’s productivity, including reducing layers in the organization, and spearheaded significant acquisitions and innovations.

Mr. Fayard contributed to the Company’s bottom line through currency, interest and tax management strategies, executed a more comprehensive partnership model with our bottling system;successful debt issuance, and developed key talent in the finance organization.

· improved employee morale as demonstrated by improved engagement scores;

·Mr. Finan completed acquisitions and led the Companyintegration of key bottling investments in China, the Philippines, Germany and the U.S., and helped lead Company-wide productivity initiatives.

Mr. Reyes led the very successful Latin America Group and continued to even more responsible corporate citizenship;develop employees and supply talent to many parts of the world. All four of the Latin America business units met or exceeded their objectives.

· improved the Company’s leadership standing in the area of diversity.

Long-Term Equity Compensation

General. We provide performance-based long-term equity compensation opportunities to our senior executives, including the Named Executive Officers, as part of their competitive pay packagetotal direct compensation because we believe they tie the interests of these individuals directly to the interests of our shareowners and thus indirectly serve to increase shareowner returns.shareowners. We also believe that long-term equity compensation is an important retention tool. We generally award

In 2007, we awarded annual long-term equity compensation to our senior executives, including the Named Executive Officers, in two forms: stock options and performance share units. In certain circumstances, we may use performance-based restrictedThe Compensation Committee determined a total target value of long-term equity to be awarded to each senior executive. This value was based on an assessment of competitive long-term incentive practices among our peer companies (listed on page 41) and each executive’s contributions to the Company’s longer term performance, as determined in the Compensation Committee’s subjective review. This value is then delivered through a combination of 60% stock instead ofoptions and 40% performance share units. This mix of equity was determined after a detailed review of competitive market practices and ensures a balance between internal and external measures of the Company’s performance as reflected in the Company’s stock price. In addition, we sometimes use performance share units or performance-based restricted stock with modest performance hurdles as a retention tool so that the award is, in essence, service-based, but providesFebruary 2008, the Company with a tax deduction. In 2006, we did not award any time-based restricted stock. The detailsbegan using the same combination of our long-term equity compensation plans can be found beginning on page 67.

Prior to 2006, Named Executive Officers, other than the Chief Executive Officer, were usually awarded both stock options and performance share units at the Compensation Committee’s meeting in

December. Beginning in 2007, all equity grants will generally be awarded in February as was the case for the Chief Executive Officer. We changed the date that equity grants are made to align decisions for all elements of compensationemployees who are eligible for long-term equity compensation. This is to ensure that all eligible participants are aligned against the same date. We make relatively few grants at other times during the year,objectives and the grants are usually in connection with hiring or compliance with foreign regulations. This change in grant date explains why none of the Named Executive Officers, other than the Chief Executive Officer,priorities. Prior to 2008, eligible employees who were not senior executives received only stock options or performance share units in 2006. No employee received extra grants as a result of the change in grant date.options.

The Compensation Committee determines actual award levels based on its review of individual performance and expected potential for future contributions to our sustainable growth. The Compensation Committee also takes into account an individual’s history of past awards, time in current position, and any change in responsibility. Long-term equity awards play no role in the determination of retirement benefits. Because

The details of our long-term incentiveequity compensation plans are performance-based, if the minimum level of performance is not achieved, the Named Executive Officer realizes no benefit from the award.can be found beginning on page 75.

Stock Options. We believe stock options are inherently performance-based because the exercise price is equal to the market value of the underlying stockCommon Stock on the date the option is granted, and thereforegranted. Therefore the option has value to the holder only if the market value of the Common Stock appreciates over time. Thus,When the stock price does not increase, the stock options are intended to provide equity compensation to our employees, including our Named Executive Officers, while simultaneously creating value for our shareowners.

As evidenced by our 2006 Outstanding Equity Awards at Fiscal Year-End table on page 54, our Named Executive Officers hold manydo not have value. For example, stock options with exercise prices that are highergranted in 1997 expired in October 2007 at a time when the market price of Common Stock was less than the market value of the Common Stock as of the end of the fiscal year.grant price. As a result, consistent with our pay for performance philosophy, they have not received significant realizable value on this elementa total of their compensation, since shareowners have not enjoyed appreciation in8,918,533 options expired unexercised, of which 118,000 were held by the stock price.Named Executive Officers.

Unlike the performance share units, which are generally limited to senior executives,In 2007, we grantgranted stock options to approximately 7,0006,800 employees. There is no relationship between the timing of theour equity award of equity grants and our release of material, non-public information. The fair market value of a share of Common Stock isoptions are granted with an exercise price equal to the average of the high and low prices on the date of grant. InThe laws of certain foreign jurisdictions the law requiresrequire additional restrictions on the calculation of the option price. Except in the case of new hires, where the grant date may occur in the future, or to comply with foreign regulations, including tax regulations, the grant date is the date the Compensation Committee tooktakes action. The Company believes that the measuremethodology used in its plans, the average of the high and low prices of the Common Stock on the grant date, is more representative of the fair value than an arbitrary closing market price. This measuremethodology has been used by the Company for over 20 years. In 2007, as a result of the Compensation Committee’s decision to take additional time to consider his equity award, Mr. Isdell’s stock options were granted one week after grants were made to the general population of eligible employees. Although the average stock price on the date of Mr. Isdell’s grant was slightly lower than the average stock price on the date options were granted to the general eligible population, the Compensation Committee granted Mr. Isdell’s options at the same exercise price as the grant to the other eligible employees, even though that price was higher than what was required.

Performance Share Units. Awards ofIn 2007 we granted performance share units are currently limitedas part of our normal award process to ourapproximately 70 senior executives, including the Named Executive Officers. Performance share units provide an opportunity for these executivesemployees to receive restricted stock if certain Company performance-relatedperformance criteria are met for thea three-year performance period. DividendsThe stock is generally restricted for an additional two years. Except in the case of retirement, dividends are paid only paid once the performance criteria are met. The following are shareowner-approved measures from which the Compensation Committee may choose when granting awards:

· increase in shareowner value

· earnings per share

· net income

· return on assets

· return on shareowners’ equity

· increase in cash flow

· operating profit or operating margins

· revenue growth

· operating expenses

· quality as determined by the Company’s quality index

· economic profit

| | · return on capital

· return on invested capital

·earnings before interest, taxes, depreciation and amortization

· goals relating to acquisitions or divestitures

· unit case volume

· operating income

· brand contribution

· value share of nonalcoholic ready-to-drink segment

· volume share of nonalcoholic ready-to-drink segment

· net revenue

· gross profit

· profit before tax

|